(Born July 5, 1853 – Died March 26, 1902)

Diamond Marketing is based on tradition and history. Very few

people are given access to gem quality rough diamonds and those who are are in a

position to make a lot of money. It's a big industry and lots of people

depend on the market being stable. The discovery of diamonds in South

Africa changed the diamond industry, as did world wars, and new

discoveries. What is of most importance to us is how diamonds were

marketed in the the late 19th and 20th centuries. In our new century

things are going to change, but we can look back, and we need to be able to

understand what happened in the last century or so to be able to deal with the

present.

BEFORE SOUTH AFRICA

India: ancient times from 4th century BC era till the 18th century

India was the first country to develop a diamond industry. Many famous stones adorning crown jewels were discovered in India. Famous stones include the Koh-i-Noor, the Olev, and the Hope Diamond. The diamonds were from alluvial deposits in the vicinity of Golconda. In 1669 Tavernier, a famous jeweler and procurer of diamonds visited India and reported that sixty thousand men worked in the diamond fields; ultimately these deposits were depleted. The end of the Indian market was around 1730 when Brazil's diamonds were found. India still produces minute quantities of diamonds, but is now mainly famous as a cutting center for very small stones, a specialty on the world market.

Brazil: 1725-1870

With the depletion of Indian diamonds, Brazil became the world's largest producer of diamonds. Again the source of diamonds was alluvial, and they were found in conglomerate and other sedimentary rocks. Though production has not ceased entirely, Brazil is now only a minor player with no influence on the market. This is because really huge primary deposits and alluvial deposits close to the primary sources were found in southern Africa beginning in the 1860s. More recently, diamonds have beeen found in Central Africa as well.

SOUTH AFRICA

Diamonds are discovered in South Africa. Erasumus Jacobs found a 22-carat diamond in 1866 near Hopetown, South Africa. The first South African diamond rush is well underway by 1870. In 1871 Cecil John Rhodes arrived at Colesber Kopje, South Africa, and rented a quarter of a claim in the De Beers Mine (which was one of two mines on the De Beers Farm; the name but not the family stuck with the diamond business). At the time Rhodes went unnoticed.

By 1873 diamond prices began to drop due to high production and economic slumping in europe, this plus the problem of open pit mining becoming untenable for small claims (31 ft2) in such a huge pit created a crisis. By 1877 miners of small claims worried that they would lose everything and began to sell out. This opened the way for great entrepreneurs such a Cecil Rhodes and Barney Barnato (originally born Barnett Issacs) to buy claims. In 1881, with £200,000 (pounds sterling) capital, Rhodes founded De Beers Mining Co. While Barnato was buying up all available shares in the Kimberley Mine, Cecil Rhodes was doing the same in the De Beers Mine. Rhodes idea was to consolidate the De Beers Diamond Mine, but his ambitions were much greater. He really wanted to control all diamond mining in South Africa.

In march 1888 under the direction of Cecil Rhodes and his stock holders De

Beers Consolidated Mines Ltd. was created by combining the old De Beers Mining

Company and the Kimberley Central owned by Barney Barnato. In 1889, Cecil

Rhodes wrote the world's largest check, up to that time, for £5,338,650 buying

the shares of Kimberley Central. De Beers now owned the De Beers Mine,

about 75% of the Kimberly Mine, and controlling interests in the

Bultfontein and Dutoitspan Mines. Cecil Rhodes & Barney Barnato life

governors and at that point De Beers owned 90% of world diamond

production. Cecil Rhodes had much greater aspirations than just

controlling the diamond. He was an imperialist and a politician.

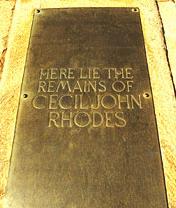

Trouble and fame were now part of his life. Cecil John Rhodes Died on

March 26, 1902. His famous last words were, "So little done, so much to

do." He was buried near Bulawayo in Rhodesia (now Zimbabwe) on a

very impressive hill granite hill called World's View.

(Born July 5, 1853 – Died March 26, 1902)

Things seldom remain unchanged in the search for riches, and competition was inevitable. New discoveries caused De Beers to lose its grip on the market, but it was still a big player and would later come back strong. By 1914, De Beer's grip had slipped to the point where it only controlled about 40% of the market. De Beers along with the Union of South Africa negotiated a quota system in 1915. This alone did not ensure stability for long.

THE MODERN SYSTEM

Ernest Oppenheimer

Ernest Oppenheimer came to South Africa from

Europe in 1902 to represent a diamond-buying company as a buyer. He became

a great entrepreneur like Rhodes and Barnato before him. His visions

included forming the Anglo-American Corporation of South Africa with the

financial assistance of J. P. Morgan. He then formed the Consolidated

Diamond Mines of South-West Africa Ltd. (called the CDM). His company,

CDM, produced 20% of South African diamonds, but his great feat was to join with

other producers to sell their diamonds through only one company the Diamond

Syndicate in London.

Oppenheimer was invited to join the board of De Beers in 1926 and was elected chairman in 1930. He then suggested that the Diamond Syndicate was not enough but that a new organization called the Diamond Corporation should pool its financial resources to buy all known and future diamond production from outside of South Africa in order to insure stable prices on the world market. The Diamond Corporation took over the the business of the Diamond Syndicate. Then the Diamond Producing Organization (DPA) was formed in 1933. The DPA included the big South African producers, the government of South Africa, and the Diamond Corporation. Then the Diamond Trading Company (DTC) was formed to buy and sort all the rough diamonds produced by the DPA. Finally, all the rough from the Diamond Trading Corporation was sold through a company called the Central Selling Organization (CSO). At present, the CSO sorts, values, and sells around 80% of the world's diamond production Since Oppenheimer created all this as the chairman of De Beers Ltd. essentially all diamonds were sold through De Beers and it could adjust the state of the market. A huge monopoly!

Diamonds sold by the Central Selling organization (CSO) are sold to only a select few companies. These companies are called Sightholders. The number of sightholders was reported in the 1970s to have been around 300 members and today at about 84 members. Sightholders attend sight meetings, called "sights", in London, 10 times a year, or about every 5 weeks. They are offered a sight or parcel of stones that may vary in value but can be from five hundred thousand to several million dollars of diamonds in one parcel. There is no bargaining over price, you either accept it or you don't and you can only decline once, if you do it again you lose your sight. The CSO has allocated certain diamonds to certain markets. The smallest stones to India, larger stones to Israel, and the largest stones to New York and Antwerp.

Not too many people complain, because the monopoly stabilizes the price of diamonds, insuring jobs for thousands and making diamonds a good investment (at least as long as the monopoly holds). Oppenheimer's plan perfectly matches supply with demand; the only one hurt is the consumer. In essence De Beers has created an artificial scarcity of diamonds to raise prices.

In 1994 the United States Justice Department charged De Beers with conspiring to fix the price of industrial diamonds. Under US antitrust laws De Beers finally pleaded guilty to running a monopoly and on July 14, 2004, De Beers paid a $10 million in fines. De Beers can now trade directly in the United States. The US diamond market spends $500 million on industrial diamonds a year and up to $60 billion in diamond jewelry purchases, making it the world's largest consumer market.

Now that De Beers can directly market to the world's largest consumer, the USA, things may change in how diamonds are distributed and this may affect the sightholder relationship with the CSO. We'll have to wait to see the outcome of this. About 20% of the world market production is not controlled by the CSO and is sold directly by producing countries such as Brazil, Venezuela, and Ghana. This is called the "Outside Market" or "Free Market". The Outside Market has the potential for trouble; many of these diamonds may be released on the market by groups that are waging war and are outside of the accepted governments that protect their people. These diamonds are sometimes called "conflict" or "blood diamonds" and are certainly a cause for concern. One example of this is the diamonds dumped on the market by Angola's UNITA group. Of course, it is not easy to recognize these diamonds, and once they enter the world markets they mix with all other diamonds.

Eventually almost all rough diamonds end up in diamond exchanges (aka as bourses), where they are sold to members of the exchange. Being a member of an exchange is an exclusive thing; no one besides a member is ever admitted within the walls of an exchange. The exchanges demand honesty and fair business practices by all their members. Supposedly, if you were to drop an envelope of diamonds in an exchange, you would have nothing to worry about. You would find your envelope pinned to a bulletin board the next day with a complete description of the stones enclosed to make it easy to recognize. Diamonds are sold in the exchanges on a handshake and a promised date of payment, no contracts or receipts. Disputes are settled by a council or tribunal whose decisions are final, and no disputes ever reach civil courts.

Links

For more information on diamonds see

The

American Museum of Natural History

or go to the following pages on this site.